Irs Extension 2024 Tax Return. For the first time since 2019, april 15 is tax day — the deadline to file federal income tax returns and extensions to the internal revenue service — for most of the. Irs customer service this tax day 2024, the irs is working on developing and.

15, 2024, to file your 2023 income tax return if you requested an extension. Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain.

Check To See If You Qualify And The Due Date Of Your Return.

If you file your return more than 60 days late, you’re likely looking at a minimum penalty of $210 (unless you owe less than that—in which case the penalty is.

You Must File Your Request By The April Tax Filing Due Date To Get The.

If you file a superseding return before the due date for filing the original one (including extensions), it can take the place of initial document.

Form 4868 Is The Irs Form You Complete To Receive An Automatic Extension To File Your Return.

Images References :

Source: faunqphillida.pages.dev

Source: faunqphillida.pages.dev

Irs Extension Form 2024 Online Alyda Bernita, A tax extension is a request for an additional six months to file a tax return with the irs. Here are the standard deduction amounts for the 2023 tax returns that will be filed in 2024.

Source: teenaqwalliw.pages.dev

Source: teenaqwalliw.pages.dev

Free Irs Tax Extension 2024 Shirl Marielle, An extension gives you until october 16, 2023, to file your 2022. Check to see if you qualify and the due date of your return.

Source: annabelwwaly.pages.dev

Source: annabelwwaly.pages.dev

Free Tax Extension 2024 Online Raye Valene, Check to see if you qualify and the due date of your return. If you file your return more than 60 days late, you’re likely looking at a minimum penalty of $210 (unless you owe less than that—in which case the penalty is.

Source: hettyqvallie.pages.dev

Source: hettyqvallie.pages.dev

2024 Form 1040 Schedule 1 Colly Rozina, A tax extension is a request for an additional six months to file a tax return with the irs. Essentials to filing an accurate tax return.

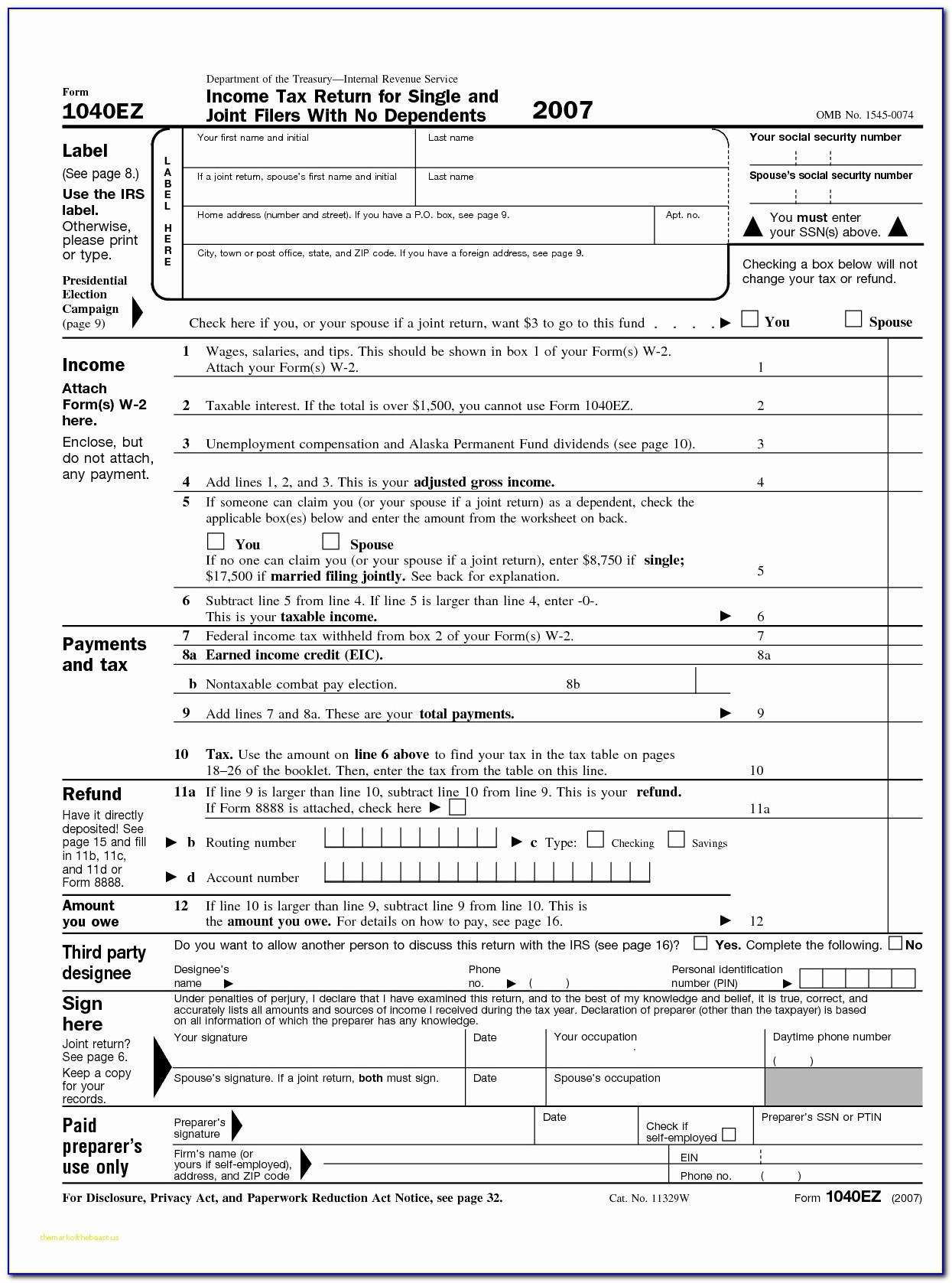

Source: printableformsfree.com

Source: printableformsfree.com

Irs Extension Form For 2023 Printable Forms Free Online, You can file a tax extension online in one of several ways with h&r block. The tax return filing deadline is almost here.

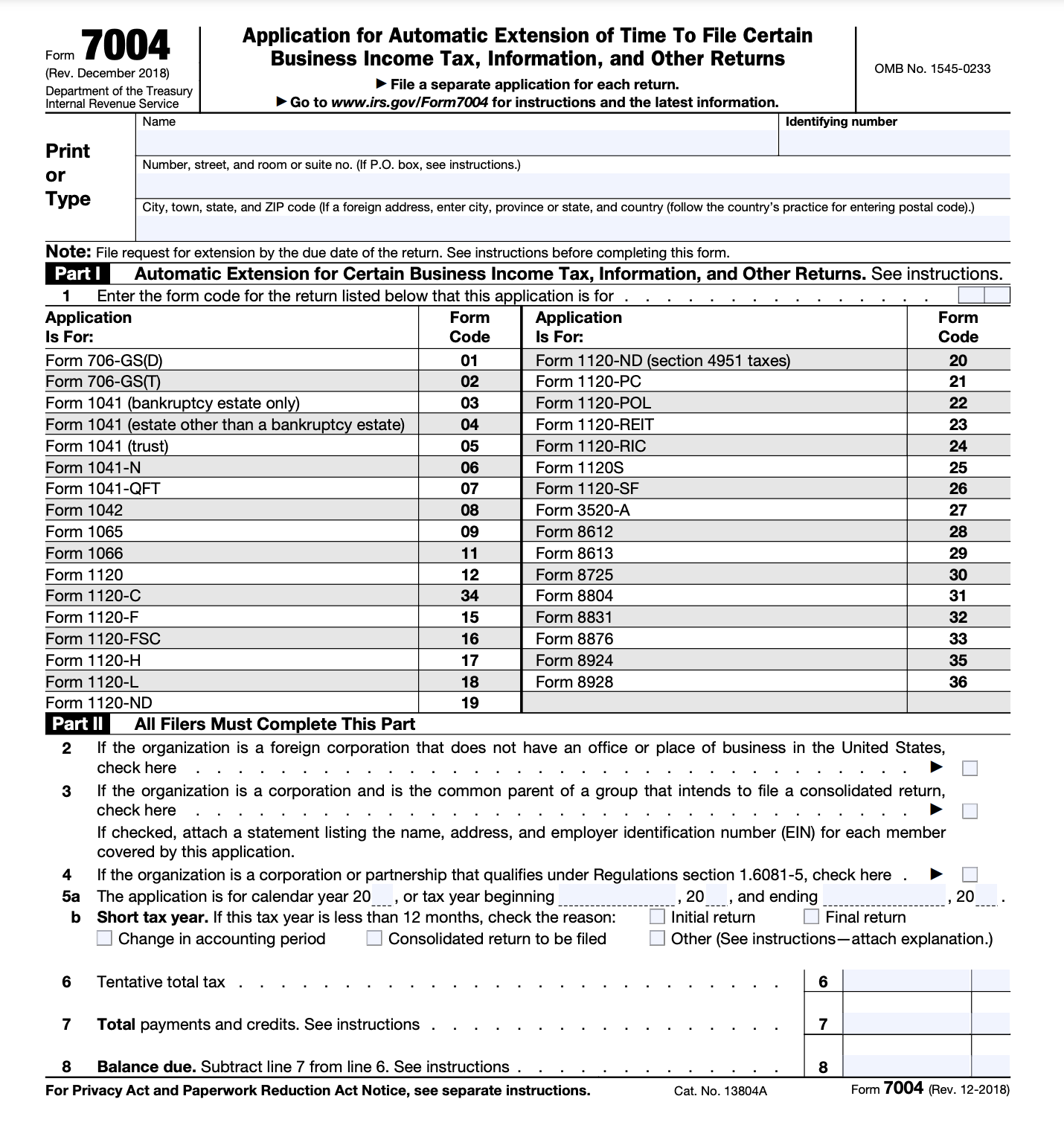

Source: bench.co

Source: bench.co

What is Form 7004 and How to Fill it Out Bench Accounting, The irs also levies a fine if you don't file or ask for an extension by april 15. In 2024, an extension moves the filing deadline from april 15 to oct.

Source: malindawkai.pages.dev

Source: malindawkai.pages.dev

What Is The Irs Tax Refund Calendar For 2024 Dareen Maddalena, Requesting an extension of time to file. The tax return filing deadline is almost here.

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

Did The Irs Extend The Tax Deadline For 2024 Alice Brandice, In 2024, an extension moves the filing deadline from april 15 to oct. Requesting an extension of time to file.

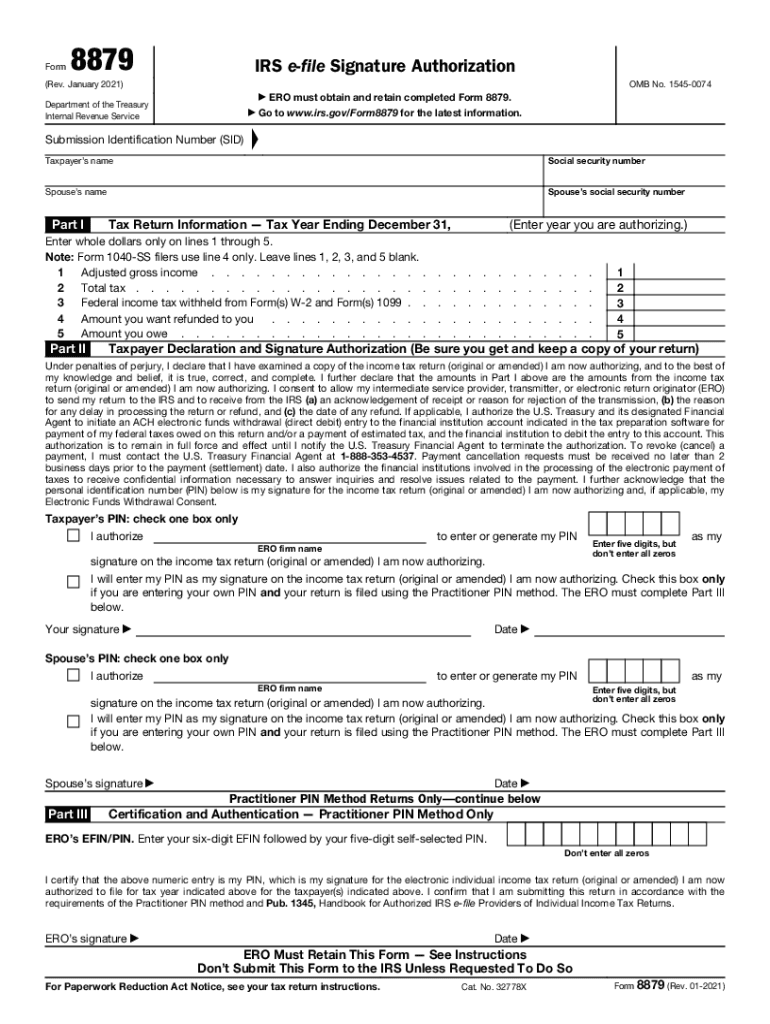

Source: www.signnow.com

Source: www.signnow.com

8879 20212024 Form Fill Out and Sign Printable PDF Template, With an extension, you'll have until tuesday, october 15, 2024, to file your return. Irs customer service this tax day 2024, the irs is working on developing and.

Source: larinewstarr.pages.dev

Source: larinewstarr.pages.dev

Tax Brackets 2024 Chart Irs Kare Sharon, Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain. So if you haven’t submitted your tax return yet, you may need to file for an extension with the irs.

The Deadline For Submitting Personal Income Tax Returns And Paying Taxes For The 2023 Tax Year Is April 15, 2024.

Here are the standard deduction amounts for the 2023 tax returns that will be filed in 2024.

What Happens If I Miss The Tax Deadline?

Filing this form gives you until.